Understanding the essential elements of aircraft finance and how to pivot toward success given the current environment

In this Q&A with AFRAA, Boeing Capital Corporation executives Vasgen Edwards, managing director; Lereece Rose, senior finance director; and Sam Muhumuza, account manager, discuss aviation finance in Africa.

What are current headwinds facing African Airlines?

Edwards: There are a number of hurdles to be met when financing aviation assets in this geography. Anecdotally, through interactions with airlines across Sub-Saharan Africa, the following challenges are apparent: recovering from ravages of the COVID-19 pandemic, finance costs, finance availability and appetite for ownership considerations. Certainly, there are positives in the region including the Single African Air Transport Market (SAATM) asserting its open skies mandate, Cape Town Convention status enabling easier repossession and importantly funding at a lower cost and global liquidity which all play an important role. Yet these factors only bear consideration once the bigger hurdles mentioned above have been crossed.

Notably, despite near-term headwinds, there are good opportunities as Africa reflects the fastest growing working age population. Also, a burgeoning freight market should create greater opportunities across the continent. Boeing estimates that by 2029, more than 1,000 aircraft will be needed in Africa, most of which will constitute growth as opposed to replacement of an aging fleet.

Boeing’s forecast of aircraft replacement in Africa

Source: Boeing

Africa’s working age population growth

Source: Boeing

How can industry navigate toward profitability post pandemic?

Return to growth pathways will require changes in approach as plans for new cap-ex are solidified. What we potentially see is an environment with closer co-operation within the existing financial ecosystem that will be augmented by an extension to new sources of financing.

The good news is that a number of financing options are available to airline operators and financiers as they explore and develop post-pandemic strategies. The full breadth of financing pathways, including lease solutions, alongside various Export Credit Agency (ECA) options, will certainly continue to play a role and discussions at the outset of any financial planning assessment should capture all the financial products that are suitable. Boeing Capital Corporation (BCC) continually works with Boeing customers and industry financiers to help determine the best solution for their particular situation. This on-going transaction support has proven instrumental in offering customers and financiers a better understanding of particular market nuances.

Boeing Capital delivery funding in Africa

Source: Boeing

What are some practical steps that can help ensure a successful financing outcome?

Muhumuza: Prior to the airline going to market, a clearly formulated strategy set out in the form a business plan will help maximize a successful outcome with stakeholders. Utilizing support from Original Equipment Manufacturers (OEMs), airlines should consider the following:

Boeing Capital preparation phase / go to market / optimize solution

Source: Boeing

What are expectations around increased finance costs relative to perceived and real risks?

Edwards: Increased risk in Africa is a reality for most financiers because their models take into account a number of factors including but not limited to:

- Defaults at both country and airline level

- Difficulty in repatriation of funds

- Economies that are largely dependent on a single resource to drive revenue and growth (e.g. oil production)

- Revenue and income currency mismatches

- The overall stability of the business, country and region

While determining the above risks is somewhat beyond the control of an airline, perceived risk can be managed to a greater degree with thorough preparation and providing comprehensive information to financiers. BCC is in a position to facilitate understanding of the market and the risk and reward framework that underpins aircraft financing. For many years, our outreach programs have facilitated the on-boarding of numerous financial institutions into the aviation financing community through regular market updates on a global basis. BCC has also invested to ensure our teams are present in the Middle East and Africa region to best understand local market conditions and developments. That connectivity is integral to building the right solutions for our customers.

Is finance availability directly correlated to the visibility of a particular airline or country? What about the role of local financiers?

Rose: There is much to be said for airlines who maintain interaction with local and international banks to leverage the best of both worlds. We have seen first-hand the value of on-boarding local institutions to fund solutions often in conjunction with international banking groups. It is well noted that longer term financing in US dollars can exert additional stress on local and regional banks. However, there is unquestionably a part-to-played by these financial institutions in the shorter tenor tranches of aircraft financing, notably PDPs and mezzanine facilities. Second, when international banks are able to fund in local currencies, due to a long established presence in a particular jurisdiction and an accumulation of revenue denominated in local currency, it provides availability that stimulates competition and bodes well for the price of financing in the local market.

What are your thoughts on a pan continental leasing platform?

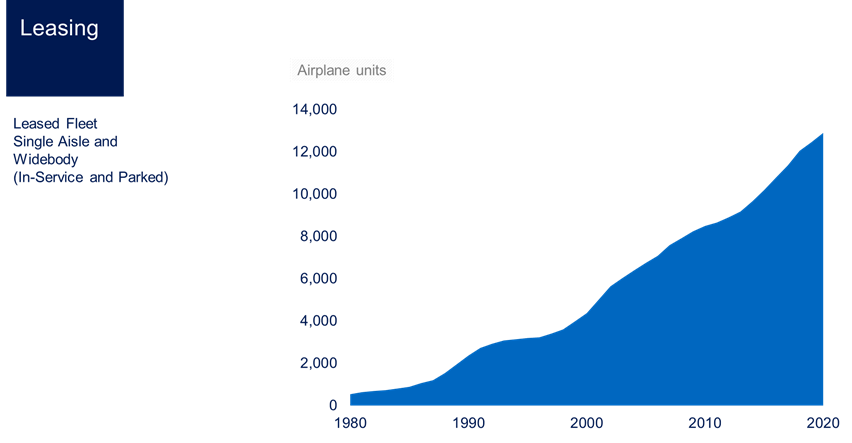

Muhumuza: Lessors are very important to aircraft finance and the number of aircraft under lease has grown exponentially since 1980. While the vision of a body that is wholly dedicated to the financing of aircraft on the African continent merits further investment and discussion, there are many capable players in the aviation financing market today. The industry should continue to use existing solutions while exploring new options that could accelerate growth of the aviation market. BCC certainly sees the benefit of multiple institutions, coordinating their combined capabilities to bring capital and solutions to airlines that are the lifeblood of the African continent. The main benefit of such a leasing platform would be to counter the effects of dollar denominated payments, especially in those airlines that generate revenue in local currencies which can be prone to fluctuation against the U.S. dollar.

Also, a leasing platform in which participant financiers span across banks, multilaterals, OEM’s and lessors enhances the diversity of the financing product. This can create interest for greater participation by financiers who would not normally consider financing in these jurisdictions.

Boeing Capital Current Aircraft Finance Market Outlook lessor analysis

Source: Boeing

Source: Boeing

What about cargo operations?

Edwards: The freighter market remains a bright spot during the pandemic. Yields have remained very high, and more freighters are flying than before the pandemic due to limited belly cargo capacity from passenger airplanes.

From a regional perspective, according to IATA, Africa cargo demand is growing and as of the first quarter of 2021, cargo operations are at 120% of normal volumes as consumers move toward e-commerce purchases and vaccinations are transported globally.

Stepping back, both financiers and investors have recognized the strength seen in the cargo market throughout the pandemic. In fact, freighters are the best performing aircraft class in terms of values during the pandemic, as the world realizes the importance of air cargo.

Revenue Tonne Kilometers have reflected a dramatic increase since the lean years prior to the pandemic and yields opportunities for all airlines but especially for the African airlines with its increasing exports and abundant resources much needed by an array of industrial sectors.

Any closing thoughts?

Rose: Overall, aviation is a growth business, with annual growth expected to be about 4% over the next 20 years. There is absolutely no question that the African aviation industry will continue to flourish and successfully adapt to a post pandemic marketplace. Aviation is an important driver of the economy and airlines are planning now for recovery and that includes working with financiers on creative solutions. Governments will also play an important role as they develop policies to best serve their respective economies and citizens. We expect that capital will continue to be routed into the sector by established players and as new entrants seek opportunities during the industry’s recovery.

Boeing in Africa

Boeing’s heritage in Africa dates back nearly 75 years. Since the introduction of the jet airplane, Boeing planes have formed the backbone of the continent’s commercial fleet. With more than 60 airline customers operating about 460 Boeing airplanes throughout Africa, Boeing represents nearly 70% of the airplane market currently in service across the continent. Currently, Boeing has offices in Johannesburg, South Africa, and Nairobi, Kenya, in addition to field service representatives with commercial customers across the continent. Boeing Capital Corporation is a global provider of financing solutions for Boeing customers.